This article describes more incentivization strategy in the a leading height, since the adopted within the uniswap-v3-staker. Just after exchanging effectively, users can access the brand new Trading Record on the swapping interface to view the transactions otherwise go back to our home display to browse the replaced tokens when needed. To help expand deal with this type of defense demands, researchers from Uniswap Labs have suggested numerous active means. They’ve been Promoting Broad-Range Liquidity,Changed TWAP Oracles, and Day Adjusted Average Price (TWMP) Oracles. With her, these actions assist do a more safe and you can resilient Uniswap v3 platform.

Using its creative provides, it’s revolutionized how decentralized money (DeFi) works, giving improved results, freedom, and you may greater control for liquidity company. This informative article dives deep on the core features of Uniswap V3, how it professionals liquidity company, and its own affect the newest DeFi ecosystem. Unlike antique acquisition publication exchanges where a buy order try matched up so you can an excellent promote order, Uniswap uses an automatic business inventor (AMM) program. There is no putting in a bid or buy publication, just the speed for how much liquidity can be acquired.

- Arbitrage exchange is another have fun with circumstances to own Uniswap v3, that allows traders when deciding to take advantageous asset of rate discrepancies across the various other decentralized transfers.

- It may be hard to comprehend the the brand new changes of each and every type, and how to use them.

- Uniswap V3 allows liquidity business available exchangeability that have all the way down funding than just was once necessary.

- Inside earlier incarnations, Uniswap you will undertake people price between one to infinity.

- Remember just how V2 invited LPs to include conditions contingent for the genuine-industry investigation in order to wise deals?

Uniswap app: Decentralized Puppy

The fresh Channel target will get so it channel from many considering pools and you may an insight and efficiency Token. If you fail to see the Tokens exchanged in your bag, you will definitely need to import her or him. As part of the example application is capability in order to tie/unwrap ETH as needed to pay for the new example WETH so you can USDC change straight from a keen ETH balance.

When Did Uniswap Launch — and What’s Uniswap V2?

After the newest guide, you should Uniswap app be able to perform and you will play a swap between any two ERC20 tokens utilizing the example’s integrated UI. Exchangeability organization, at the same time, already are viewing charges begin to go up. According to Flipside’s analysis, since Saturday, Get ten, the top earner had already collected more than $step 3.6 million inside costs, if you are number two got gained almost $3 million.

Furthermore, as opposed to previous versions that used fungible ERC-20 tokens, LP positions inside Uniswap v3 is actually illustrated from the NFTs (ERC-721 tokens). It is because for every LP has its own price curve, and then make their positions type of and you can requiring NFTs so you can represent her or him. Choosing ranging from Uniswap v2 and you may v3 utilizes your individual requires and you will choice. To possess productive LPs who’re more comfortable with handling its ranks and you can search high efficiency, v3 offers increased efficiency and you will control. For individuals who prioritize simplicity and you may a couch potato way of exchangeability supply, Uniswap v2’s simplicity might possibly be a better fit.

This study underscores the benefits of v3’s concentrated exchangeability model, making it possible for LPs to increase the investment allocation and you can potentially get to higher output. With respect to the chart, commission production was 1st low in early days after the launch of Uniswap v3 than others to your v2 ,while the liquidity and you may trading regularity remained gathering. Although not, as more field players began integrating v3, fee production for the the brand new variation continuously enhanced, surpassing the ones from v2 by june of 2021. Permissionless structure means the fresh protocol’s features are completely unlock for social fool around with, and no capability to precisely limit that will otherwise don’t have fun with him or her. Anybody can swap, give exchangeability, or perform the newest places during the have a tendency to.

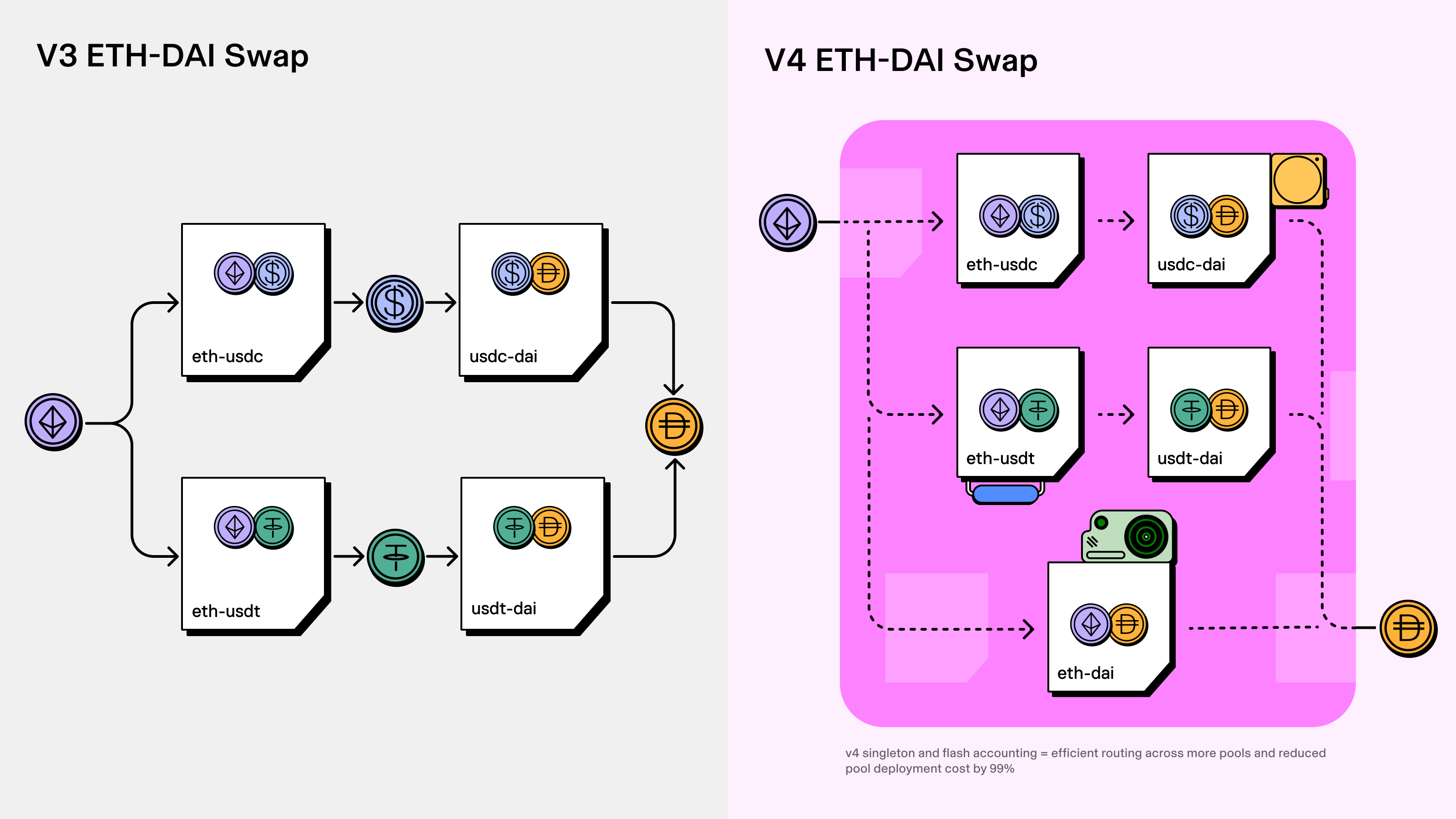

The newest change router supports all of the very first criteria away from a front side-prevent providing exchange. They natively helps unmarried trades (x so you can y) and you will multihop positions (e.grams. x so you can y to help you z). The newest core consists of a single factory, a pool deployer, plus the of several swimming pools the brand new warehouse can establish. Periphery agreements interact with a minumum of one Core contracts however they are not an element of the center. He or she is designed to offer ways of getting the fresh key one improve clearness and affiliate protection.

Information this type of distinctions assists buyers find the maximum adaptation due to their certain change requires and you can issues. Even if type of percentage tiers can result in some extent out of exchangeability fragmentation, we believe that all sets tend to calibrate so you can an obvious payment level, which then serves as the newest canonical business. I anticipate such-type resource sets in order to congregate within the 0.05% commission tier and you can pairs such ETH/DAI to make use of 0.30%, while you are unique assets might find step 1.00% change fees appropriate. Uniswap V3 is the third form of the brand new Uniswap decentralized replace (DEX) protocol built on the fresh Ethereum blockchain. It’s enhanced overall performance and consumer experience, as well as new features and you may capabilities, compared to earlier versions of your own program. It is built to assists the fresh trade of ERC-20 tokens or any other electronic possessions within the an excellent trustless and you will decentralized style.

Another significant change in Uniswap V3 ‘s the capability to create multi-advantage pools. In past times, Uniswap pools is only able to have a few possessions (i.elizabeth., an investing partners), but V3 lets pools so you can contain sigbificantly more than just two property. It not simply increases the form of property designed for change as well as advances investment efficiency, while the exchangeability organization could offer liquidity in order to several sets immediately. Uniswap V3 is the third iteration of 1 of the very most well-known decentralized transfers (DEX) worldwide.

The newest protocol is additionally immutable, put differently maybe not upgradeable. Zero group might be able to pause the new deals, contrary exchange performance, or else alter the decisions of your own method by any means. It is well worth listing you to Uniswap Governance has got the best (but no obligation) in order to divert a percentage of change costs on the any pool so you can a specified address.

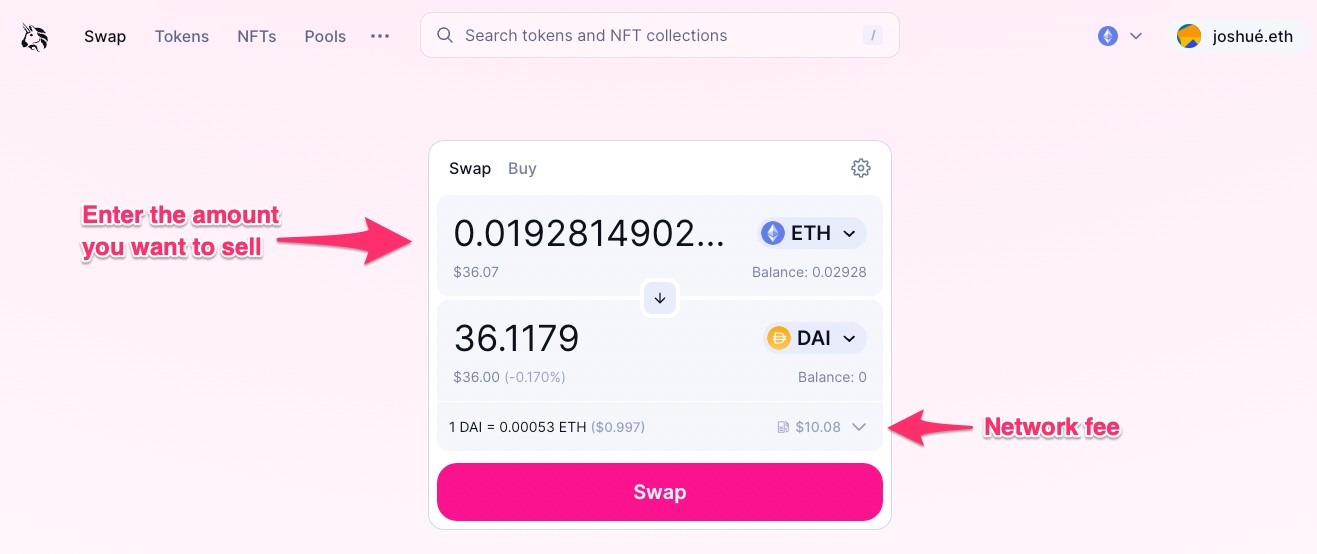

The available choices of this particular feature and you will supported percentage tips will get depend on the legislation. Uniswap V3 also offers the choice to improve certain parameters of the new change. Including, you might establish just as much slippage (the amount lost or achieved down to market action when you’re performing an order) and the go out the order would be to waiting.

Uniswap is one of the most well-known cryptocurrency decentralized transfers (DEXs), unveiling in the November 2018. They pioneered the newest automatic industry founder (AMM) model, as opposed to the antique buy book-centered used by exchanges. Uniswap works on the Ethereum blockchain and you can spends a lot of wise deals in order to safely exchange ERC-20 tokens anywhere between pages. LPs playing with Uniswap subscribe to the newest Ethereum blockchain’s gas demands.

There are numerous words that may explain the function of Uniswap. It is a fellow-to-fellow opportunities you to definitely isn’t subject to a central expert. By turning to the effectiveness of Uniswap v3, profiles is also unlock an entire prospective away from DeFi, helping greater usage of, freedom, and you will control over its economic possessions. While the community keeps growing and you may develop, Uniswap v3 will play a vital role inside the framing the fresh future of decentralized fund.